41+ private-label mortgage-backed securities

Private label mortgage-backed securities are often assigned ratings by credit rating agencies based on. Non-agency mortgage backed securities Most Popular Terms.

Business Template S Support Desk

Web The standard of creditworthiness for purposes of the definition of the term mortgage related security in section 3a41 of the Exchange Act is a security that is rated in one of the two highest rating categories by at least one NRSRO.

. Web Mar 03 2023. Non-QM Focus In early 2018 we reviewed how RMBS 20 issuance volumes in the Private-Label Residential Mortgage Backed Securities PLRMBS market had shifted towards the Non-Performing Loans NPL and Re-Performing Loans RPL along with emerging non-QM as early as 2015. Through our Sequoia securitization platform we have securitized 42 billion of residential mortgage debt since we were founded in 1994.

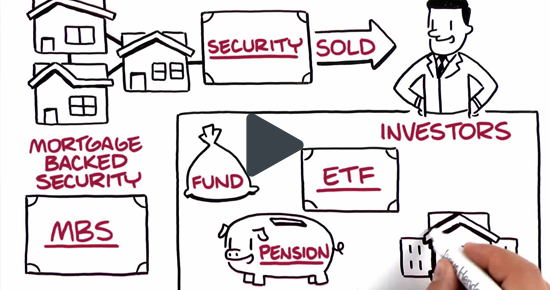

Mortgage-backed securities MBS represent an indirect ownership interest in mortgage loans made by financial institutions. Web Focused explanations written in a clear illustrative narrative quickly get you up to speed on. Certain structured credit products particularly.

The Mortgage Industry Standards Maintenance Organization MISMO said Thursday it is seeking comment on the Private Label Residential Mortgage-Backed Securities PL RMBS Specification and Implementation. Private-label mortgage-backed securities and mortgage-backed securities might offer a great choice if you dont actually want to manage an investment property. Banks and mortgage companies sell mortgages to other companies.

Web Private-label MBS issuance to hit a post-crisis record in 2022. These groups then bundle the mortgages together. In 2018 private-label RMBS issuances all of which were unregistered only amounted to roughly 181 billion.

Web Private-label mortgage backed securities See. Web A mortgage-backed security MBS is an investment similar to a bond that consists of a bundle of home loans bought from the banks that issued them. Web The mortgage-backed security issuer typically segregates the collateral or deposits it in the care of a designated trustee a party who holds and manages the collateral for the exclusive benefit of the mortgage-backed security bondholders.

And since the end of the financial crisis we have sponsored more than 40 of all the new-issue PLS transactions. An MBS is an asset-backed security that is traded on the secondary market and that enables investors to profit from the mortgage business without the need to directly buy or sell home loans. A number of insured banks with portfolio holdings in private label mortgage-backed securities collateralized debt obligations CDOs or asset-backed securities ABS are facing heightened losses as a result of significant investments in these products.

Taken together these are substantive and important reforms that should promote a more stable robust and safe and sound market for mortgage finance. The guide will facilitate the electronic exchange of mortgage asset data to credit rating agencies. Another post-financial crisis record for private-label residential mortgage-backed securities is expected in 2022 with issuance expected to increase 15 over this year a.

If you invest in MBS you are buying a claim to the cash flow coming from these debts. Web Issuance of bonds backed by private residential mortgages reached around 84 billion this year close to 72 percent of 2020s full-year total according to the Journal. Web Private-Label RMBS Performance.

Web In 2008 all private-label RMBS issuances both SEC-registered and unregistered markedly declined to roughly 52 billion and have continued to remain at low levels to date. Web Mortgage-backed securities MBS are investments based on pools of home mortgages. Earnings per share EPS Beta Market capitalization Outstanding Market value.

Web A total of 10 private-label deals valued at nearly 54 billion hit the market in the first two weeks of 2022 HousingWire reported last week but thats already old news. Web Mortgage-backed securities MBS are fixed-income securities that utilize mortgage loans as collateral and the source of funds for payments on the security. The valuation of fixed-income securities metrics valuation framework and return analysis Residential mortgage-backed securities security cash flow mortgage dollar roll adjustable rate mortgages and private label MBS Prepayment modeling and the.

The value of MBS is secured by the value of the underlying bundle of mortgages. Web The annual issuance volume measured by unpaid principal balance UPB of mortgages associated with these risk transfer programs reached 4171 billion in 2015 of which 3112 billion UPB represented the reference mortgages for 126 billion of issued structured debt notes of the GSEs. Web The private label MBS market includes loans that are not guaranteed by the government or the agencies and is a shadow of its former self.

The creation of MBS begins with a financial institution such as a bank or credit union extend-ing a mortgage loan to a borrower. Web mortgage loans without any form of government guarantee. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages.

Web As with any type of investment more inherently risky investments offer the potential for greater reward than safer investments. And The standard of creditworthiness for purposes of the definition of the term small. Web The CFPB has also issued servicing standards that apply to all mortgage loans however they only address borrower-servicer interactions.

During the peak years private label MBS issuance.

Mortgage Backed Security Wikipedia

Drs A

Special Study Staff Report On Enhancing Disclosure In The Mortgage Backed Securities Markets

Private Label Mbs Market Facing Strong Headwinds Housingwire

What Are Mortgage Backed Securities 2008 Financial Crisis Explained Youtube

1977 Us 100m Deal For Bank Of America The First Private Label Mbs Ifr

Private Label Mortgage Securities Near Revival Wsj

Finc3018 Full Set Of Notes Bank3011 Bank Financial Management Usyd Thinkswap

Land For Sale 2201 Brookside Rd Macungie Pa 18062 Usa United States Colliers

Residential Mortgage Backed Securities Collateralized Mortgage Obligations Project Invested

The Rebirth Of Securitization Where Is The Private Label Mortgage Market The Journal Of Structured Finance

Safety Soundness And The Evolution Of The U S Banking Industry Document Gale Academic Onefile

The Rebirth Of Securitization Where Is The Private Label Mortgage Market The Journal Of Structured Finance

Pdf Inequality Household Debt Ageing And Bubbles A Model Of Demand Side Secular Stagnation

Ideal Asset Allocation By Age For Singaporeans Financial Horse

High Quality Short Duration 1 5 Year Atlanta Capital

Mortgage Backed Securities A Quick Education By Janus Henderson Investors Harvest